Note

Go to the end to download the full example code. or to run this example in your browser via JupyterLite or Binder

Tweedie regression on insurance claims#

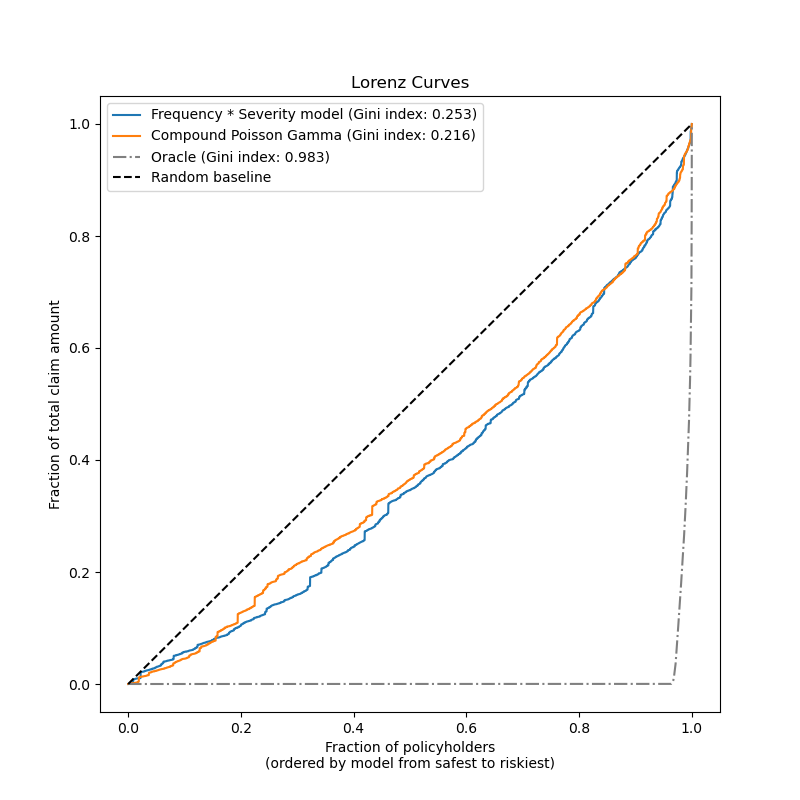

This example illustrates the use of Poisson, Gamma and Tweedie regression on the French Motor Third-Party Liability Claims dataset, and is inspired by an R tutorial [1].

In this dataset, each sample corresponds to an insurance policy, i.e. a contract within an insurance company and an individual (policyholder). Available features include driver age, vehicle age, vehicle power, etc.

A few definitions: a claim is the request made by a policyholder to the insurer to compensate for a loss covered by the insurance. The claim amount is the amount of money that the insurer must pay. The exposure is the duration of the insurance coverage of a given policy, in years.

Here our goal is to predict the expected value, i.e. the mean, of the total claim amount per exposure unit also referred to as the pure premium.

There are several possibilities to do that, two of which are:

Model the number of claims with a Poisson distribution, and the average claim amount per claim, also known as severity, as a Gamma distribution and multiply the predictions of both in order to get the total claim amount.

Model the total claim amount per exposure directly, typically with a Tweedie distribution of Tweedie power \(p \in (1, 2)\).

In this example we will illustrate both approaches. We start by defining a few helper functions for loading the data and visualizing results.

from functools import partial

import matplotlib.pyplot as plt

import numpy as np

import pandas as pd

from sklearn.datasets import fetch_openml

from sklearn.metrics import (

mean_absolute_error,

mean_squared_error,

mean_tweedie_deviance,

)

def load_mtpl2(n_samples=None):

"""Fetch the French Motor Third-Party Liability Claims dataset.

Parameters

----------

n_samples: int, default=None

number of samples to select (for faster run time). Full dataset has

678013 samples.

"""

# freMTPL2freq dataset from https://www.openml.org/d/41214

df_freq = fetch_openml(data_id=41214, as_frame=True).data

df_freq["IDpol"] = df_freq["IDpol"].astype(int)

df_freq.set_index("IDpol", inplace=True)

# freMTPL2sev dataset from https://www.openml.org/d/41215

df_sev = fetch_openml(data_id=41215, as_frame=True).data

# sum ClaimAmount over identical IDs

df_sev = df_sev.groupby("IDpol").sum()

df = df_freq.join(df_sev, how="left")

df["ClaimAmount"] = df["ClaimAmount"].fillna(0)

# unquote string fields

for column_name in df.columns[[t is object for t in df.dtypes.values]]:

df[column_name] = df[column_name].str.strip("'")

return df.iloc[:n_samples]

def plot_obs_pred(

df,

feature,

weight,

observed,

predicted,

y_label=None,

title=None,

ax=None,

fill_legend=False,

):

"""Plot observed and predicted - aggregated per feature level.

Parameters

----------

df : DataFrame

input data

feature: str

a column name of df for the feature to be plotted

weight : str

column name of df with the values of weights or exposure

observed : str

a column name of df with the observed target

predicted : DataFrame

a dataframe, with the same index as df, with the predicted target

fill_legend : bool, default=False

whether to show fill_between legend

"""

# aggregate observed and predicted variables by feature level

df_ = df.loc[:, [feature, weight]].copy()

df_["observed"] = df[observed] * df[weight]

df_["predicted"] = predicted * df[weight]

df_ = (

df_.groupby([feature])[[weight, "observed", "predicted"]]

.sum()

.assign(observed=lambda x: x["observed"] / x[weight])

.assign(predicted=lambda x: x["predicted"] / x[weight])

)

ax = df_.loc[:, ["observed", "predicted"]].plot(style=".", ax=ax)

y_max = df_.loc[:, ["observed", "predicted"]].values.max() * 0.8

p2 = ax.fill_between(

df_.index,

0,

y_max * df_[weight] / df_[weight].values.max(),

color="g",

alpha=0.1,

)

if fill_legend:

ax.legend([p2], ["{} distribution".format(feature)])

ax.set(

ylabel=y_label if y_label is not None else None,

title=title if title is not None else "Train: Observed vs Predicted",

)

def score_estimator(

estimator,

X_train,

X_test,

df_train,

df_test,

target,

weights,

tweedie_powers=None,

):

"""Evaluate an estimator on train and test sets with different metrics"""

metrics = [

("D² explained", None), # Use default scorer if it exists

("mean abs. error", mean_absolute_error),

("mean squared error", mean_squared_error),

]

if tweedie_powers:

metrics += [

(

"mean Tweedie dev p={:.4f}".format(power),

partial(mean_tweedie_deviance, power=power),

)

for power in tweedie_powers

]

res = []

for subset_label, X, df in [

("train", X_train, df_train),

("test", X_test, df_test),

]:

y, _weights = df[target], df[weights]

for score_label, metric in metrics:

if isinstance(estimator, tuple) and len(estimator) == 2:

# Score the model consisting of the product of frequency and

# severity models.

est_freq, est_sev = estimator

y_pred = est_freq.predict(X) * est_sev.predict(X)

else:

y_pred = estimator.predict(X)

if metric is None:

if not hasattr(estimator, "score"):

continue

score = estimator.score(X, y, sample_weight=_weights)

else:

score = metric(y, y_pred, sample_weight=_weights)

res.append({"subset": subset_label, "metric": score_label, "score": score})

res = (

pd.DataFrame(res)

.set_index(["metric", "subset"])

.score.unstack(-1)

.round(4)

.loc[:, ["train", "test"]]

)

return res

Loading datasets, basic feature extraction and target definitions#

We construct the freMTPL2 dataset by joining the freMTPL2freq table,

containing the number of claims (ClaimNb), with the freMTPL2sev table,

containing the claim amount (ClaimAmount) for the same policy ids

(IDpol).

from sklearn.compose import ColumnTransformer

from sklearn.pipeline import make_pipeline

from sklearn.preprocessing import (

FunctionTransformer,

KBinsDiscretizer,

OneHotEncoder,

StandardScaler,

)

df = load_mtpl2()

# Correct for unreasonable observations (that might be data error)

# and a few exceptionally large claim amounts

df["ClaimNb"] = df["ClaimNb"].clip(upper=4)

df["Exposure"] = df["Exposure"].clip(upper=1)

df["ClaimAmount"] = df["ClaimAmount"].clip(upper=200000)

# If the claim amount is 0, then we do not count it as a claim. The loss function

# used by the severity model needs strictly positive claim amounts. This way

# frequency and severity are more consistent with each other.

df.loc[(df["ClaimAmount"] == 0) & (df["ClaimNb"] >= 1), "ClaimNb"] = 0

log_scale_transformer = make_pipeline(

FunctionTransformer(func=np.log), StandardScaler()

)

column_trans = ColumnTransformer(

[

(

"binned_numeric",

KBinsDiscretizer(n_bins=10, random_state=0),

["VehAge", "DrivAge"],

),

(

"onehot_categorical",

OneHotEncoder(),

["VehBrand", "VehPower", "VehGas", "Region", "Area"],

),

("passthrough_numeric", "passthrough", ["BonusMalus"]),

("log_scaled_numeric", log_scale_transformer, ["Density"]),

],

remainder="drop",

)

X = column_trans.fit_transform(df)

# Insurances companies are interested in modeling the Pure Premium, that is

# the expected total claim amount per unit of exposure for each policyholder

# in their portfolio:

df["PurePremium"] = df["ClaimAmount"] / df["Exposure"]

# This can be indirectly approximated by a 2-step modeling: the product of the

# Frequency times the average claim amount per claim:

df["Frequency"] = df["ClaimNb"] / df["Exposure"]

df["AvgClaimAmount"] = df["ClaimAmount"] / np.fmax(df["ClaimNb"], 1)

with pd.option_context("display.max_columns", 15):

print(df[df.ClaimAmount > 0].head())

ClaimNb Exposure Area VehPower VehAge DrivAge BonusMalus VehBrand \

IDpol

139 1 0.75 F 7 1 61 50 B12

190 1 0.14 B 12 5 50 60 B12

414 1 0.14 E 4 0 36 85 B12

424 2 0.62 F 10 0 51 100 B12

463 1 0.31 A 5 0 45 50 B12

VehGas Density Region ClaimAmount PurePremium Frequency \

IDpol

139 'Regular' 27000 R11 303.00 404.000000 1.333333

190 'Diesel' 56 R25 1981.84 14156.000000 7.142857

414 'Regular' 4792 R11 1456.55 10403.928571 7.142857

424 'Regular' 27000 R11 10834.00 17474.193548 3.225806

463 'Regular' 12 R73 3986.67 12860.225806 3.225806

AvgClaimAmount

IDpol

139 303.00

190 1981.84

414 1456.55

424 5417.00

463 3986.67

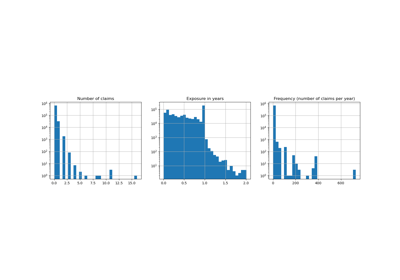

Frequency model – Poisson distribution#

The number of claims (ClaimNb) is a positive integer (0 included).

Thus, this target can be modelled by a Poisson distribution.

It is then assumed to be the number of discrete events occurring with a

constant rate in a given time interval (Exposure, in units of years).

Here we model the frequency y = ClaimNb / Exposure, which is still a

(scaled) Poisson distribution, and use Exposure as sample_weight.

from sklearn.linear_model import PoissonRegressor

from sklearn.model_selection import train_test_split

df_train, df_test, X_train, X_test = train_test_split(df, X, random_state=0)

Let us keep in mind that despite the seemingly large number of data points in this dataset, the number of evaluation points where the claim amount is non-zero is quite small:

len(df_test)

169504

len(df_test[df_test["ClaimAmount"] > 0])

6237

As a consequence, we expect a significant variability in our evaluation upon random resampling of the train test split.

The parameters of the model are estimated by minimizing the Poisson deviance

on the training set via a Newton solver. Some of the features are collinear

(e.g. because we did not drop any categorical level in the OneHotEncoder),

we use a weak L2 penalization to avoid numerical issues.

glm_freq = PoissonRegressor(alpha=1e-4, solver="newton-cholesky")

glm_freq.fit(X_train, df_train["Frequency"], sample_weight=df_train["Exposure"])

scores = score_estimator(

glm_freq,

X_train,

X_test,

df_train,

df_test,

target="Frequency",

weights="Exposure",

)

print("Evaluation of PoissonRegressor on target Frequency")

print(scores)

Evaluation of PoissonRegressor on target Frequency

subset train test

metric

D² explained 0.0448 0.0427

mean abs. error 0.1379 0.1378

mean squared error 0.2441 0.2246

Note that the score measured on the test set is surprisingly better than on the training set. This might be specific to this random train-test split. Proper cross-validation could help us to assess the sampling variability of these results.

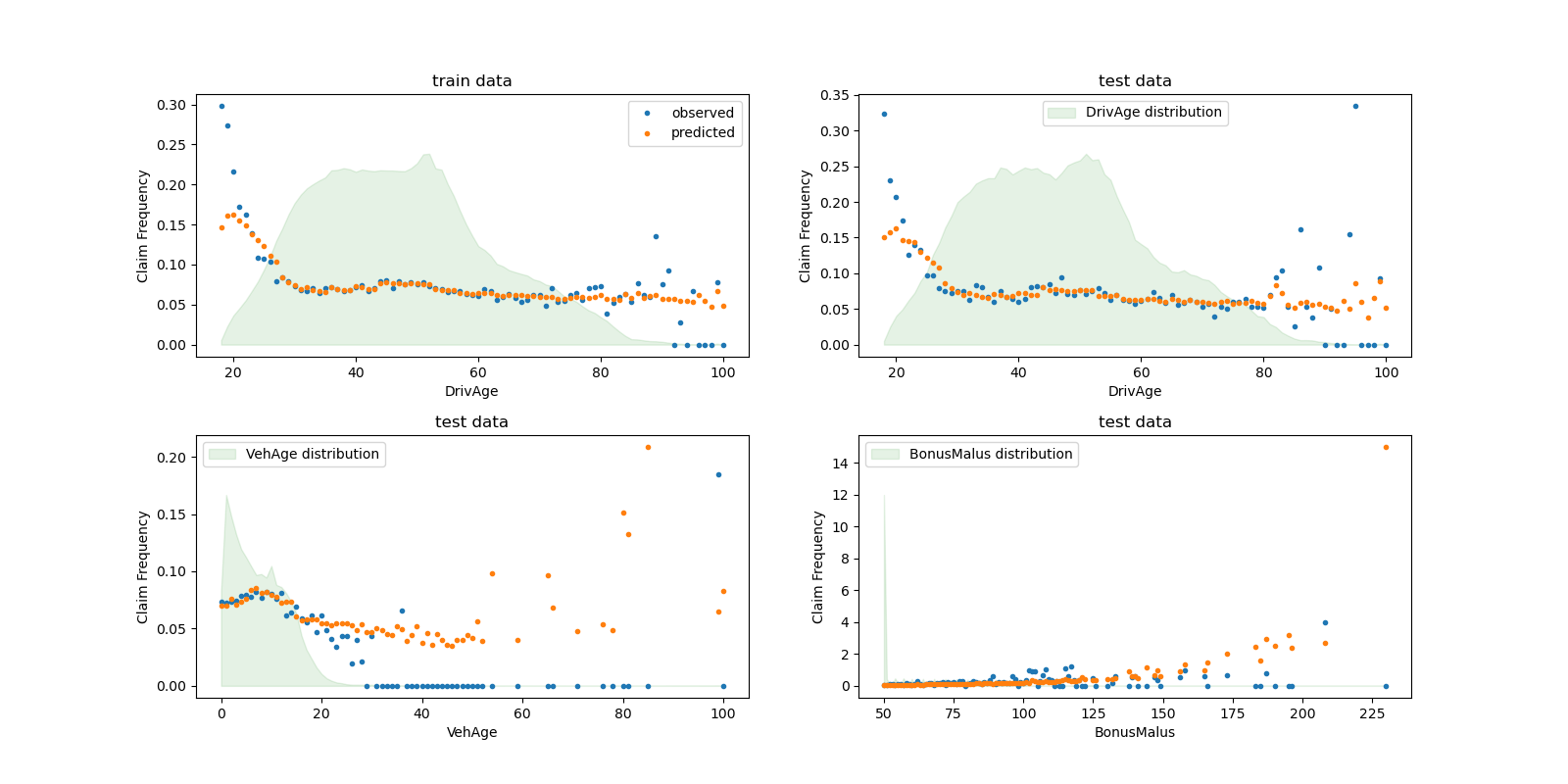

We can visually compare observed and predicted values, aggregated by the

drivers age (DrivAge), vehicle age (VehAge) and the insurance

bonus/malus (BonusMalus).

fig, ax = plt.subplots(ncols=2, nrows=2, figsize=(16, 8))

fig.subplots_adjust(hspace=0.3, wspace=0.2)

plot_obs_pred(

df=df_train,

feature="DrivAge",

weight="Exposure",

observed="Frequency",

predicted=glm_freq.predict(X_train),

y_label="Claim Frequency",

title="train data",

ax=ax[0, 0],

)

plot_obs_pred(

df=df_test,

feature="DrivAge",

weight="Exposure",

observed="Frequency",

predicted=glm_freq.predict(X_test),

y_label="Claim Frequency",

title="test data",

ax=ax[0, 1],

fill_legend=True,

)

plot_obs_pred(

df=df_test,

feature="VehAge",

weight="Exposure",

observed="Frequency",

predicted=glm_freq.predict(X_test),

y_label="Claim Frequency",

title="test data",

ax=ax[1, 0],

fill_legend=True,

)

plot_obs_pred(

df=df_test,

feature="BonusMalus",

weight="Exposure",

observed="Frequency",

predicted=glm_freq.predict(X_test),

y_label="Claim Frequency",

title="test data",

ax=ax[1, 1],

fill_legend=True,

)

According to the observed data, the frequency of accidents is higher for

drivers younger than 30 years old, and is positively correlated with the

BonusMalus variable. Our model is able to mostly correctly model this

behaviour.

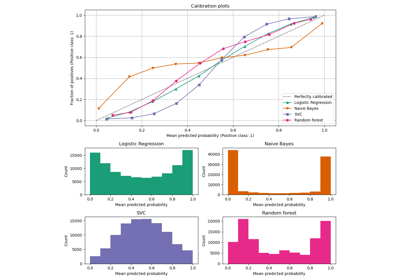

Severity Model - Gamma distribution#

The mean claim amount or severity (AvgClaimAmount) can be empirically

shown to follow approximately a Gamma distribution. We fit a GLM model for

the severity with the same features as the frequency model.

Note:

We filter out

ClaimAmount == 0as the Gamma distribution has support on \((0, \infty)\), not \([0, \infty)\).We use

ClaimNbassample_weightto account for policies that contain more than one claim.

from sklearn.linear_model import GammaRegressor

mask_train = df_train["ClaimAmount"] > 0

mask_test = df_test["ClaimAmount"] > 0

glm_sev = GammaRegressor(alpha=10.0, solver="newton-cholesky")

glm_sev.fit(

X_train[mask_train.values],

df_train.loc[mask_train, "AvgClaimAmount"],

sample_weight=df_train.loc[mask_train, "ClaimNb"],

)

scores = score_estimator(

glm_sev,

X_train[mask_train.values],

X_test[mask_test.values],

df_train[mask_train],

df_test[mask_test],

target="AvgClaimAmount",

weights="ClaimNb",

)

print("Evaluation of GammaRegressor on target AvgClaimAmount")

print(scores)

Evaluation of GammaRegressor on target AvgClaimAmount

subset train test

metric

D² explained 3.900000e-03 4.400000e-03

mean abs. error 1.756746e+03 1.744042e+03

mean squared error 5.801770e+07 5.030677e+07

Those values of the metrics are not necessarily easy to interpret. It can be insightful to compare them with a model that does not use any input features and always predicts a constant value, i.e. the average claim amount, in the same setting:

from sklearn.dummy import DummyRegressor

dummy_sev = DummyRegressor(strategy="mean")

dummy_sev.fit(

X_train[mask_train.values],

df_train.loc[mask_train, "AvgClaimAmount"],

sample_weight=df_train.loc[mask_train, "ClaimNb"],

)

scores = score_estimator(

dummy_sev,

X_train[mask_train.values],

X_test[mask_test.values],

df_train[mask_train],

df_test[mask_test],

target="AvgClaimAmount",

weights="ClaimNb",

)

print("Evaluation of a mean predictor on target AvgClaimAmount")

print(scores)

Evaluation of a mean predictor on target AvgClaimAmount

subset train test

metric

D² explained 0.000000e+00 -0.000000e+00

mean abs. error 1.756687e+03 1.744497e+03

mean squared error 5.803882e+07 5.033764e+07

We conclude that the claim amount is very challenging to predict. Still, the

GammaRegressor is able to leverage some

information from the input features to slightly improve upon the mean

baseline in terms of D².

Note that the resulting model is the average claim amount per claim. As such, it is conditional on having at least one claim, and cannot be used to predict the average claim amount per policy. For this, it needs to be combined with a claims frequency model.

print(

"Mean AvgClaim Amount per policy: %.2f "

% df_train["AvgClaimAmount"].mean()

)

print(

"Mean AvgClaim Amount | NbClaim > 0: %.2f"

% df_train["AvgClaimAmount"][df_train["AvgClaimAmount"] > 0].mean()

)

print(

"Predicted Mean AvgClaim Amount | NbClaim > 0: %.2f"

% glm_sev.predict(X_train).mean()

)

print(

"Predicted Mean AvgClaim Amount (dummy) | NbClaim > 0: %.2f"

% dummy_sev.predict(X_train).mean()

)

Mean AvgClaim Amount per policy: 71.78

Mean AvgClaim Amount | NbClaim > 0: 1951.21

Predicted Mean AvgClaim Amount | NbClaim > 0: 1940.95

Predicted Mean AvgClaim Amount (dummy) | NbClaim > 0: 1978.59

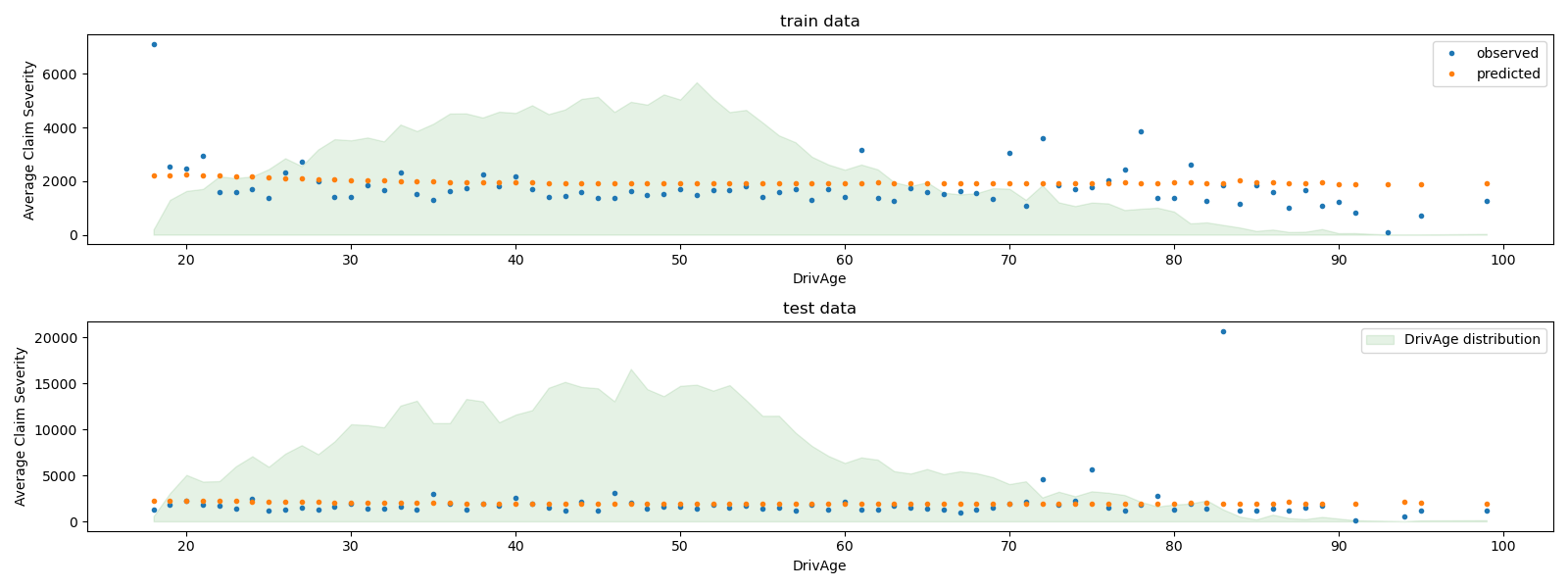

We can visually compare observed and predicted values, aggregated for

the drivers age (DrivAge).

fig, ax = plt.subplots(ncols=1, nrows=2, figsize=(16, 6))

plot_obs_pred(

df=df_train.loc[mask_train],

feature="DrivAge",

weight="Exposure",

observed="AvgClaimAmount",

predicted=glm_sev.predict(X_train[mask_train.values]),

y_label="Average Claim Severity",

title="train data",

ax=ax[0],

)

plot_obs_pred(

df=df_test.loc[mask_test],

feature="DrivAge",

weight="Exposure",

observed="AvgClaimAmount",

predicted=glm_sev.predict(X_test[mask_test.values]),

y_label="Average Claim Severity",

title="test data",

ax=ax[1],

fill_legend=True,

)

plt.tight_layout()

Overall, the drivers age (DrivAge) has a weak impact on the claim

severity, both in observed and predicted data.