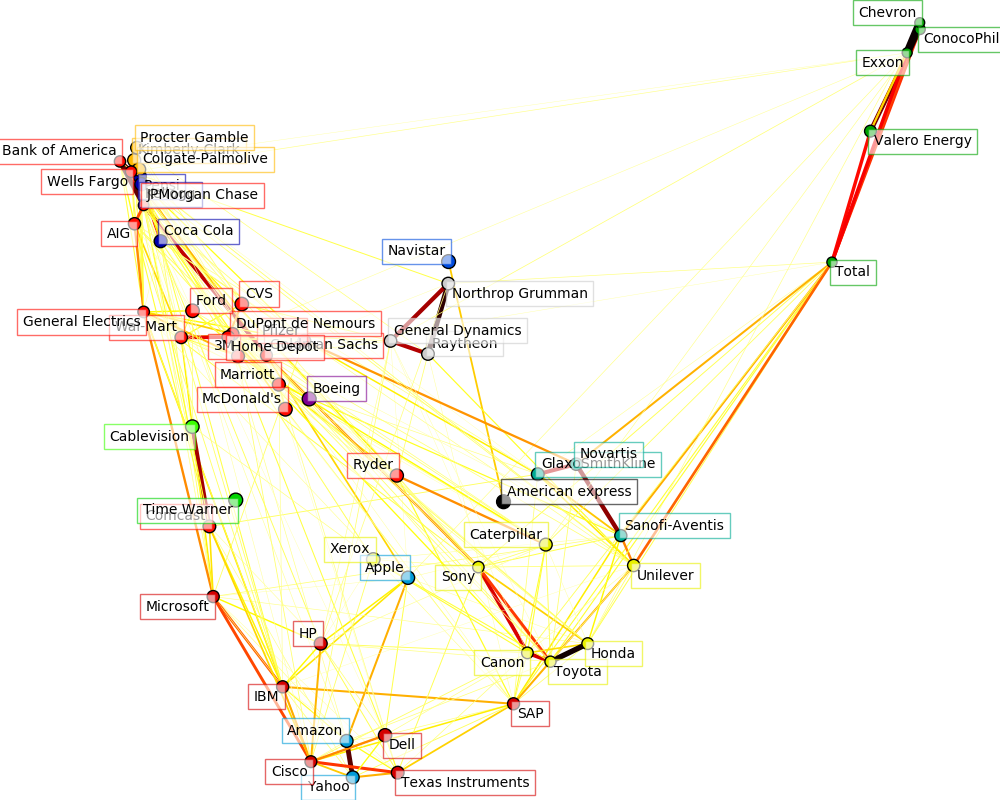

Visualizing the stock market structure¶

This example employs several unsupervised learning techniques to extract the stock market structure from variations in historical quotes.

The quantity that we use is the daily variation in quote price: quotes that are linked tend to cofluctuate during a day.

Learning a graph structure¶

We use sparse inverse covariance estimation to find which quotes are correlated conditionally on the others. Specifically, sparse inverse covariance gives us a graph, that is a list of connection. For each symbol, the symbols that it is connected too are those useful to explain its fluctuations.

Clustering¶

We use clustering to group together quotes that behave similarly. Here, amongst the various clustering techniques available in the scikit-learn, we use Affinity Propagation as it does not enforce equal-size clusters, and it can choose automatically the number of clusters from the data.

Note that this gives us a different indication than the graph, as the graph reflects conditional relations between variables, while the clustering reflects marginal properties: variables clustered together can be considered as having a similar impact at the level of the full stock market.

Embedding in 2D space¶

For visualization purposes, we need to lay out the different symbols on a 2D canvas. For this we use Manifold learning techniques to retrieve 2D embedding.

Visualization¶

The output of the 3 models are combined in a 2D graph where nodes represents the stocks and edges the:

- cluster labels are used to define the color of the nodes

- the sparse covariance model is used to display the strength of the edges

- the 2D embedding is used to position the nodes in the plan

This example has a fair amount of visualization-related code, as visualization is crucial here to display the graph. One of the challenge is to position the labels minimizing overlap. For this we use an heuristic based on the direction of the nearest neighbor along each axis.

print(__doc__)

# Author: Gael Varoquaux gael.varoquaux@normalesup.org

# License: BSD 3 clause

from datetime import datetime

import numpy as np

from matplotlib import pyplot as plt

from matplotlib.collections import LineCollection

from six.moves.urllib.request import urlopen

from six.moves.urllib.parse import urlencode

from sklearn import cluster, covariance, manifold

Retrieve the data from Internet

def quotes_historical_google(symbol, date1, date2):

"""Get the historical data from Google finance.

Parameters

----------

symbol : str

Ticker symbol to query for, for example ``"DELL"``.

date1 : datetime.datetime

Start date.

date2 : datetime.datetime

End date.

Returns

-------

X : array

The columns are ``date`` -- datetime, ``open``, ``high``,

``low``, ``close`` and ``volume`` of type float.

"""

params = urlencode({

'q': symbol,

'startdate': date1.strftime('%b %d, %Y'),

'enddate': date2.strftime('%b %d, %Y'),

'output': 'csv'

})

url = 'http://www.google.com/finance/historical?' + params

response = urlopen(url)

dtype = {

'names': ['date', 'open', 'high', 'low', 'close', 'volume'],

'formats': ['object', 'f4', 'f4', 'f4', 'f4', 'f4']

}

converters = {0: lambda s: datetime.strptime(s.decode(), '%d-%b-%y')}

return np.genfromtxt(response, delimiter=',', skip_header=1,

dtype=dtype, converters=converters,

missing_values='-', filling_values=-1)

# Choose a time period reasonably calm (not too long ago so that we get

# high-tech firms, and before the 2008 crash)

d1 = datetime(2003, 1, 1)

d2 = datetime(2008, 1, 1)

symbol_dict = {

'TOT': 'Total',

'XOM': 'Exxon',

'CVX': 'Chevron',

'COP': 'ConocoPhillips',

'VLO': 'Valero Energy',

'MSFT': 'Microsoft',

'IBM': 'IBM',

'TWX': 'Time Warner',

'CMCSA': 'Comcast',

'CVC': 'Cablevision',

'YHOO': 'Yahoo',

'DELL': 'Dell',

'HPQ': 'HP',

'AMZN': 'Amazon',

'TM': 'Toyota',

'CAJ': 'Canon',

'SNE': 'Sony',

'F': 'Ford',

'HMC': 'Honda',

'NAV': 'Navistar',

'NOC': 'Northrop Grumman',

'BA': 'Boeing',

'KO': 'Coca Cola',

'MMM': '3M',

'MCD': 'McDonald\'s',

'PEP': 'Pepsi',

'K': 'Kellogg',

'UN': 'Unilever',

'MAR': 'Marriott',

'PG': 'Procter Gamble',

'CL': 'Colgate-Palmolive',

'GE': 'General Electrics',

'WFC': 'Wells Fargo',

'JPM': 'JPMorgan Chase',

'AIG': 'AIG',

'AXP': 'American express',

'BAC': 'Bank of America',

'GS': 'Goldman Sachs',

'AAPL': 'Apple',

'SAP': 'SAP',

'CSCO': 'Cisco',

'TXN': 'Texas Instruments',

'XRX': 'Xerox',

'WMT': 'Wal-Mart',

'HD': 'Home Depot',

'GSK': 'GlaxoSmithKline',

'PFE': 'Pfizer',

'SNY': 'Sanofi-Aventis',

'NVS': 'Novartis',

'KMB': 'Kimberly-Clark',

'R': 'Ryder',

'GD': 'General Dynamics',

'RTN': 'Raytheon',

'CVS': 'CVS',

'CAT': 'Caterpillar',

'DD': 'DuPont de Nemours'}

symbols, names = np.array(list(symbol_dict.items())).T

quotes = [

quotes_historical_google(symbol, d1, d2) for symbol in symbols

]

close_prices = np.vstack([q['close'] for q in quotes])

open_prices = np.vstack([q['open'] for q in quotes])

# The daily variations of the quotes are what carry most information

variation = close_prices - open_prices

Learn a graphical structure from the correlations

edge_model = covariance.GraphLassoCV()

# standardize the time series: using correlations rather than covariance

# is more efficient for structure recovery

X = variation.copy().T

X /= X.std(axis=0)

edge_model.fit(X)

Cluster using affinity propagation

_, labels = cluster.affinity_propagation(edge_model.covariance_)

n_labels = labels.max()

for i in range(n_labels + 1):

print('Cluster %i: %s' % ((i + 1), ', '.join(names[labels == i])))

Out:

Cluster 1: American express

Cluster 2: Boeing

Cluster 3: Pepsi, Coca Cola, Kellogg

Cluster 4: Navistar

Cluster 5: Apple, Amazon, Yahoo

Cluster 6: GlaxoSmithKline, Novartis, Sanofi-Aventis

Cluster 7: ConocoPhillips, Chevron, Total, Valero Energy, Exxon

Cluster 8: Time Warner

Cluster 9: Cablevision

Cluster 10: Sony, Caterpillar, Canon, Toyota, Honda, Xerox, Unilever

Cluster 11: Kimberly-Clark, Colgate-Palmolive, Procter Gamble

Cluster 12: Ryder, Goldman Sachs, Wal-Mart, General Electrics, Pfizer, Marriott, 3M, Comcast, Wells Fargo, DuPont de Nemours, CVS, Bank of America, AIG, Home Depot, Ford, JPMorgan Chase, McDonald's

Cluster 13: Microsoft, SAP, IBM, Texas Instruments, HP, Dell, Cisco

Cluster 14: Raytheon, General Dynamics, Northrop Grumman

Find a low-dimension embedding for visualization: find the best position of the nodes (the stocks) on a 2D plane

# We use a dense eigen_solver to achieve reproducibility (arpack is

# initiated with random vectors that we don't control). In addition, we

# use a large number of neighbors to capture the large-scale structure.

node_position_model = manifold.LocallyLinearEmbedding(

n_components=2, eigen_solver='dense', n_neighbors=6)

embedding = node_position_model.fit_transform(X.T).T

Visualization

plt.figure(1, facecolor='w', figsize=(10, 8))

plt.clf()

ax = plt.axes([0., 0., 1., 1.])

plt.axis('off')

# Display a graph of the partial correlations

partial_correlations = edge_model.precision_.copy()

d = 1 / np.sqrt(np.diag(partial_correlations))

partial_correlations *= d

partial_correlations *= d[:, np.newaxis]

non_zero = (np.abs(np.triu(partial_correlations, k=1)) > 0.02)

# Plot the nodes using the coordinates of our embedding

plt.scatter(embedding[0], embedding[1], s=100 * d ** 2, c=labels,

cmap=plt.cm.spectral)

# Plot the edges

start_idx, end_idx = np.where(non_zero)

# a sequence of (*line0*, *line1*, *line2*), where::

# linen = (x0, y0), (x1, y1), ... (xm, ym)

segments = [[embedding[:, start], embedding[:, stop]]

for start, stop in zip(start_idx, end_idx)]

values = np.abs(partial_correlations[non_zero])

lc = LineCollection(segments,

zorder=0, cmap=plt.cm.hot_r,

norm=plt.Normalize(0, .7 * values.max()))

lc.set_array(values)

lc.set_linewidths(15 * values)

ax.add_collection(lc)

# Add a label to each node. The challenge here is that we want to

# position the labels to avoid overlap with other labels

for index, (name, label, (x, y)) in enumerate(

zip(names, labels, embedding.T)):

dx = x - embedding[0]

dx[index] = 1

dy = y - embedding[1]

dy[index] = 1

this_dx = dx[np.argmin(np.abs(dy))]

this_dy = dy[np.argmin(np.abs(dx))]

if this_dx > 0:

horizontalalignment = 'left'

x = x + .002

else:

horizontalalignment = 'right'

x = x - .002

if this_dy > 0:

verticalalignment = 'bottom'

y = y + .002

else:

verticalalignment = 'top'

y = y - .002

plt.text(x, y, name, size=10,

horizontalalignment=horizontalalignment,

verticalalignment=verticalalignment,

bbox=dict(facecolor='w',

edgecolor=plt.cm.spectral(label / float(n_labels)),

alpha=.6))

plt.xlim(embedding[0].min() - .15 * embedding[0].ptp(),

embedding[0].max() + .10 * embedding[0].ptp(),)

plt.ylim(embedding[1].min() - .03 * embedding[1].ptp(),

embedding[1].max() + .03 * embedding[1].ptp())

plt.show()

Total running time of the script: (0 minutes 33.937 seconds)

plot_stock_market.pyplot_stock_market.ipynb